Strategies for Expanding Your Mutual Fund Distribution Business

Over the past decade, the Indian mutual fund sector has witnessed remarkable expansion. From May 2014 to January 2024, the net AUM has surged nearly fourfold, soaring from Rs 10.11 trillion to Rs 52.89 trillion. Understand the key strategies for MFDs and IFAs to enhance business growth.

Mutual Fund Industry Growth

The AUM-to-GDP ratio, a measure of mutual fund penetration in the economy, has risen to approximately 15% today from 7-8% a decade ago. While this figure still trails the global average of about 75%, it underscores a significant surge in AUM.

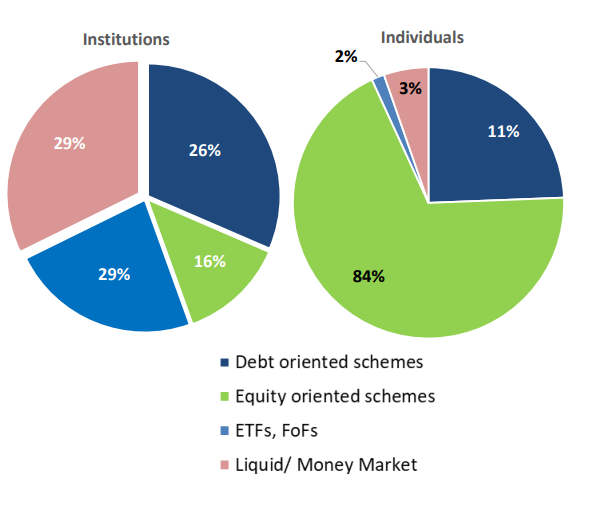

Notably, individual investors, including retail and High Net Worth Individuals (HNIs), now hold a larger proportion of the industry's assets, accounting for 60.1% as of January 2024. Moreover, these investors have allocated a substantial portion (84%) of their investments to equity-oriented mutual funds, indicating a willingness to take risks for potentially higher returns compared to traditional investment avenues.

Pie Charts: Investor Categories Across Scheme Types

Data as of Jan 31, 2024 (Source: AMFI)

B30 locations, referring to areas beyond the top 30 geographical locations, are emerging as significant contributors to mutual fund inflows, representing 26% of individual assets as of January 2024.

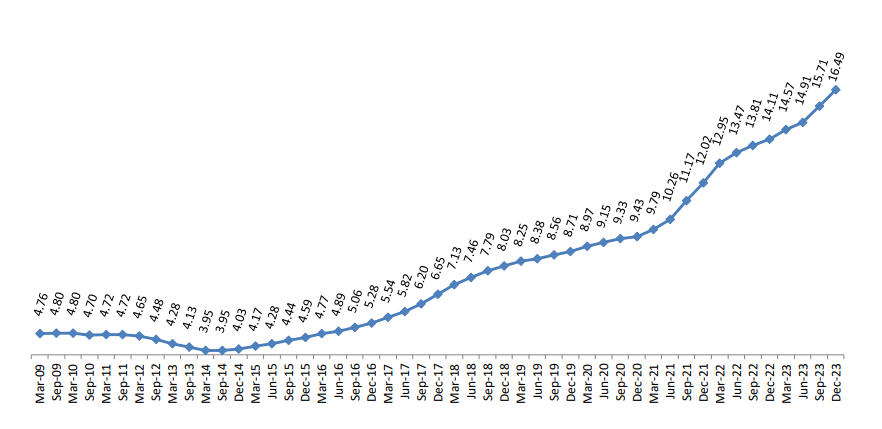

Investors predominantly utilize Systematic Investment Plans (SIPs) and lump sum investments to enter the mutual fund market. This trend has led to a substantial increase in folio counts, which rose from approximately 4 crore in May 2014 to 16.49 crore by December 2023.

Graph 1: Increase in mutual folio counts over the years

Data as of Dec 29, 2023 (Source: AMFI)

The Role of Mutual Fund Distributors (MFDs) and Independent Financial Advisors (IFAs)

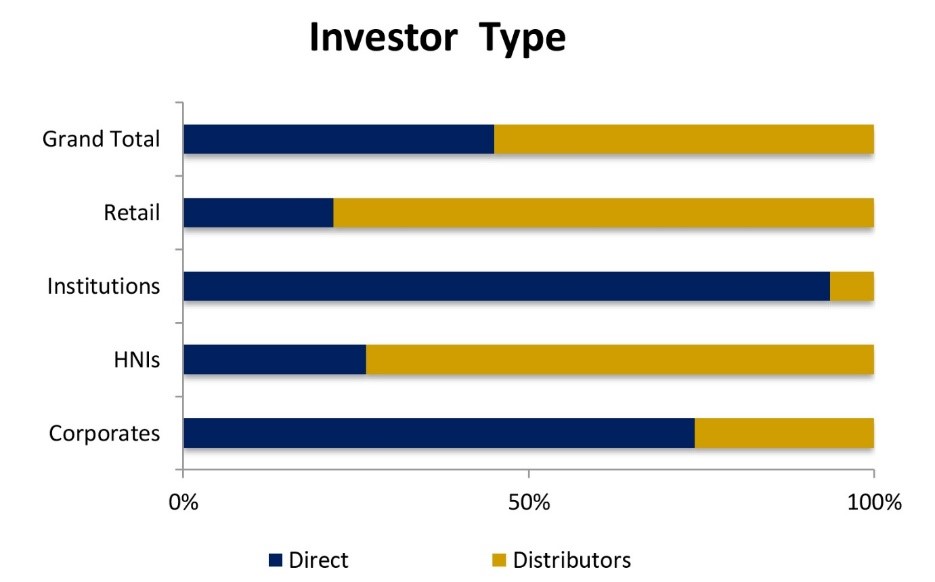

Despite the availability of direct investment channels, a considerable portion of retail and HNI investors still rely on MFDs or IFAs for guidance, with distributors, including banks, managing over 50% of the industry's assets as of January 2024.

Graph 2: Distributor v/s Direct

Data as of Jan 31, 2024 (Source: AMFI)

Strategies for MFDs and IFAs

1.Establish Trust and Confidence: MFDs and IFAs must differentiate themselves by providing honest, ethical advice, prioritizing client interests, and guiding them through wealth creation endeavours.

2.Offer Tailored Financial Solutions: Tailor product recommendations to align with individual investors' risk tolerance, financial goals, and investment horizons, utilizing comprehensive research and need-based analysis.

3.Embrace Technological Advancements: Embrace technology to streamline client servicing, reduce operational costs, enhance accessibility, and ensure transparency. Platforms like MF Utility (MFU) and BSE STAR MF offer convenient transaction facilities and integration with Registrar and Transfer Agents (RTAs).

4.Harness the Power of Social Media: Utilize social media platforms to broaden outreach, engage with prospective clients, and share valuable insights and educational content to build brand credibility and attract potential investors.

In conclusion, by adopting these strategies and positioning themselves as financial guardians, MFDs and IFAs can capitalize on the burgeoning opportunities within the mutual fund distribution landscape.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.